Financing of statutory health insurance funds

Since January 2016, many health insurance companies have increased their additional contributions. Why is this an important and necessary step for the health insurance funds and how does the system of financing statutory health insurance funds actually work?? The AOK Hessen clarifies.

Health fund and additional contribution

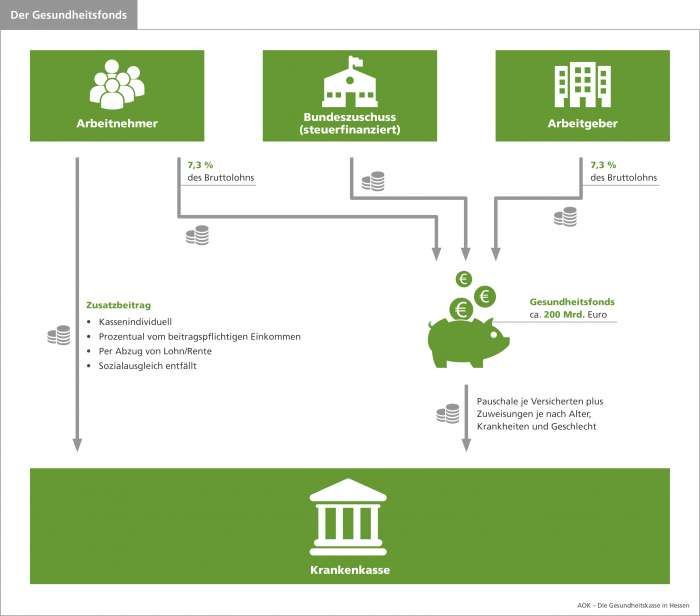

In order to understand why the additional contribution is levied, one must first understand what the contributions of the health insurance funds are made up of. In 2009, the so-called health fund was established. This is made up of various revenues: 7.3% of the employee’s gross salary, 7.3% of the employer’s gross salary, and a tax-financed federal subsidy.

Health fund and its shares to the health insurance companies

The health fund is thus a kind of money collection point. From this the contributions to the health insurance companies will be distributed. It is important that not all health insurance funds receive the same share. Although each health insurance company receives a fixed amount per insured person, it also receives a risk surcharge, which is calculated individually according to the existing illnesses of an insured person.

This “risk structure equalization” (RSA) takes into account characteristics such as age, gender and a “catalog” of 80 different diseases of the insured persons. As a result, health insurers that cover a higher proportion of older or chronically ill patients will receive a health account. of seriously ill people insured, also higher allocations.

Now, however, after distribution, it is still possible that a health insurance fund will need more money for the medical treatment of its customers. Here the regulation of the additional contribution takes effect. So if the fund has more expenses than it receives from the health fund, it must levy an additional contribution from its customers. Currently, there is hardly a health insurance company that can do without the additional contribution.

Every year the Federal Ministry of Health calculates an average additional contribution. For 2016, it is 1.1. Health insurers can use the average premium as a guide, but are free to set their own contribution levels. The AOK Hessen goes the step of the adjustment to 1.1% with.

AOK Hessen has also decided to offer its customers more and even better services starting in 2016. Thus, the “health account” introduced in 2015 expands to eight benefits. Through the virtual health account, you can get up to 400 euros back for important examinations. And so is every other insured person in your family.

You can find out here which benefits are included and how the health account works.